The pension model is unsustainable: the data that (almost) no one dares to reveal

Paradoxically, the state has become the greatest source of inequality: in this case, intergenerational

That Social Security is an unsustainable system is already a mainstream debate. A different matter is that neither politicians nor subsidized media address the problem directly. On the contrary, a massive machinery of intergenerational inequality is simply being fueled.

Jon González, a highly active tax analyst on social media and one of the most well-known figures in this field, has just summarized the problem in a useful thread on X. The contributions, González insists, only cover seven out of every ten euros of contributory pensions. The rest comes from the Treasury or from new debt:

This is something that all kinds of economic and social bodies had been warning about. The fact that Social Security depends on transfers from the State constitutes pure large-scale accounting fiction. It would be something like the right pocket of your pants owing money to the left pocket. The data speak for themselves.

Very generous pensions

To begin with, Spain pays the highest average initial pension in the OECD in relation to the last salary. Specifically, 80% compared to the OECD average of 56%. In other words, this is a system that has lost any financial credibility between contributions and benefits. The basic reason for this is twofold: i) demographic pressure, and ii) the indexation of pensions to the CPI.

The accounting translation of this situation is the well-known "State transfers." By May, Social Security had received €15.452 billion in transfers to balance its accounts, 31% more than in 2024. The government plans to contribute more than €62 billion throughout 2025, double the previous year and almost twice the annual budget of the Ministry of Education. Without these injections, the system would already be dragging a deficit of €12.698 billion.

The fact that the system is divorced from its natural income (contributions) is also glaringly obvious. Income from contributions rose by 7.1% year-on-year and reached €72.687 billion by May. Even so, they only cover about 70% of pension spending, as González points out. On top of all this, every payroll revalued with the CPI widens the gap.

Seniors increasingly well-off

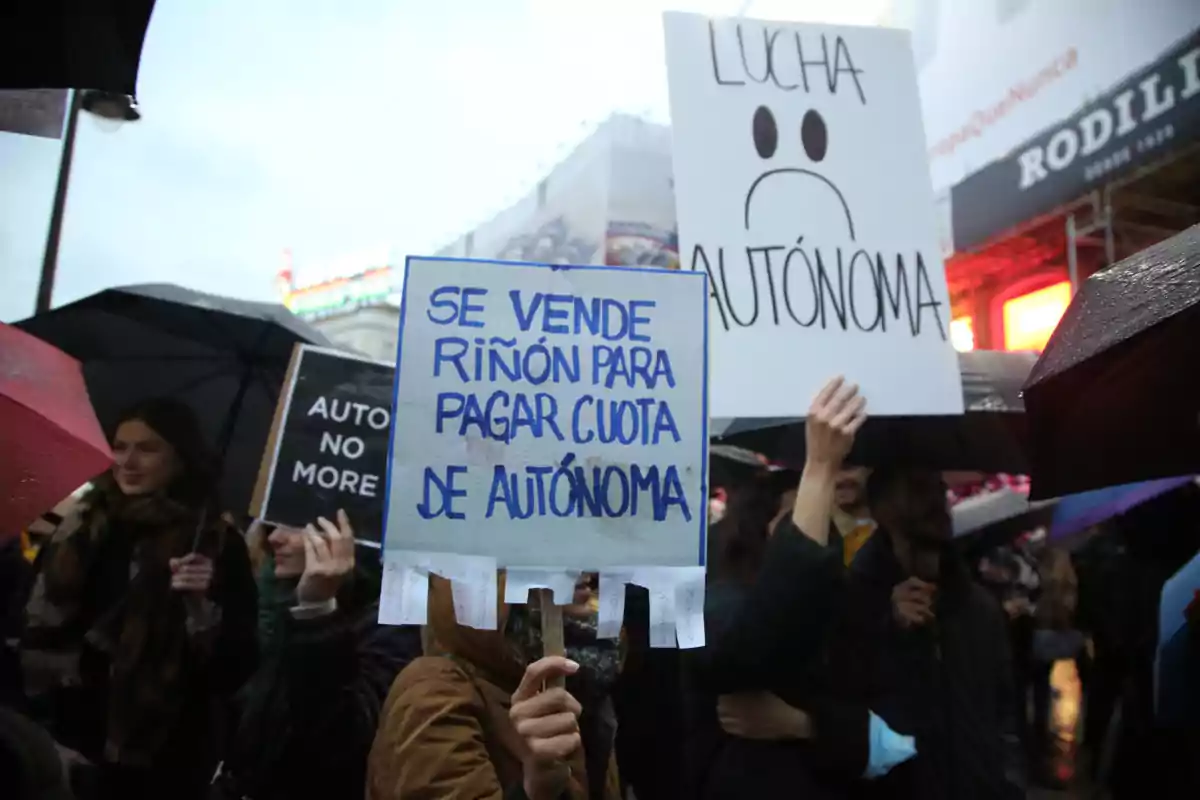

Naturally, this translates into enormous intergenerational inequality gaps. Between 2003 and 2023, for example, the real income of those over 65 grew by 22%; that of those under 35, on the other hand, fell by 12%, according to Eurostat. This way, the senior poverty rate is now the lowest among all age cohorts.

Meanwhile, this fiscal overweighting of pensions comes at the expense of other social benefits. The more than €50 billion that are diverted to pensions each year is equivalent to what the State spends on research, housing, and justice combined. We are talking about the State not being an element of wealth distribution, but rather an element of inequality distribution.

Way out?

No one fails to see that pensions are held hostage by a convergence of demographic and party interests. This is key to understanding what possible solutions the problem might have. More specifically, it shows that from public power it is practically unfeasible to find a solution due to electoral interests.

On the one hand, cutting spending in other areas is not an option because it is already minimal. On the other hand, increasing revenue through taxes is not either because the tax burden is already weighing heavily on taxpayers. This way, only more public debt is expected, which ultimately translates into the persistent inflation in which we live.

More posts: