BBVA's Special Notice: This Simple Gesture Saves the Day for Millions of Spaniards

BBVA exposes certain gestures that will help ensure your account doesn't suffer security issues and it's that easy

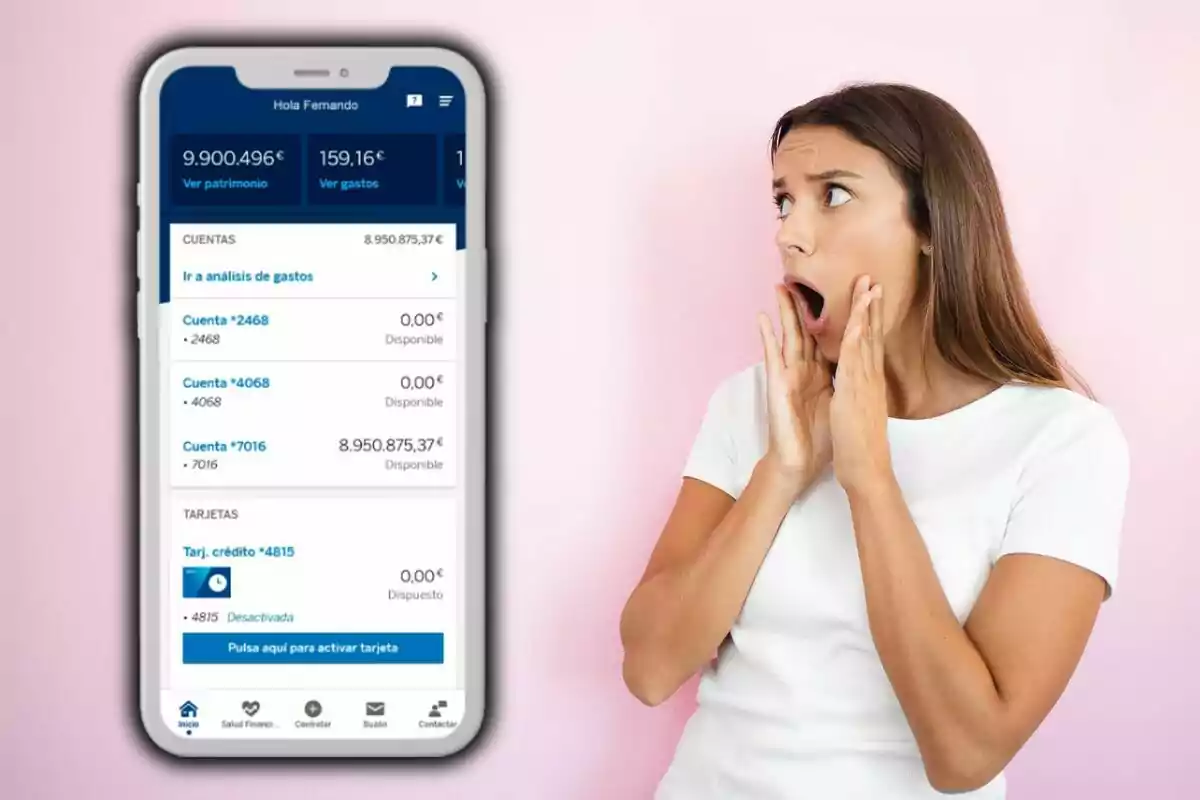

BBVA has issued an important notice for all its customers, highlighting an essential measure to strengthen the online security of your finances. When making online purchases, it is crucial to use the dynamic CVV offered by the Aqua Card. This simple action has saved many users from potential fraud.

BBVA emphasizes the importance of using the dynamic CVV for every online purchase. Unlike the static one, which is fixed and can be vulnerable if someone obtains your data, the dynamic CVV changes all the time, offering an additional layer of protection.

BBVA Warns: Do This to Strengthen the Online Security of Your Finances

This is especially relevant in an environment where cyber threats are on the rise. When making an online purchase, follow these steps to use the dynamic CVV:

- Access the BBVA App: Log in with your credentials.

- Select Your Aqua Card: Within the application, choose the card you wish to use for the purchase.

- Obtain the Dynamic CVV: Click on the "View CVV" option, and a three-digit code valid for a short period will be caused.

- Complete Your Purchase: Enter the dynamic CVV in the corresponding field to finalize the transaction.

This process ensures that each purchase is protected with a unique code, thus making it difficult for unauthorized third parties to gain access.

Why Can It Be Dangerous Not to Do This? Take Note

Not using the dynamic CVV increases the risk of your data being used fraudulently. If someone obtains the static CVV of your card, they could make purchases without your consent. The dynamic one, by constantly changing, significantly reduces this possibility because the code is valid only for a brief period and for a single transaction.

By not using the dynamic CVV, you expose yourself to financial fraud. We are talking about unauthorized purchases that affect your balance and can create complications in managing your finances.

Be careful with the misuse of your personal and financial data by third parties. We can suffer a loss of trust and insecurity when making online transactions, limiting your ability to take advantage of digital finances.

To avoid these situations, it is essential to adopt safe practices when shopping online. In addition to using the dynamic CVV, BBVA recommends accessing online banking from secure environments, keeping the BBVA app updated, and being alert to any suspicious activity in your accounts.

More posts: