The latest from BBVA interests thousands of Spaniards: this simple and starting today

BBVA has an important update for customers coming from another bank, and it's going to surprise them.

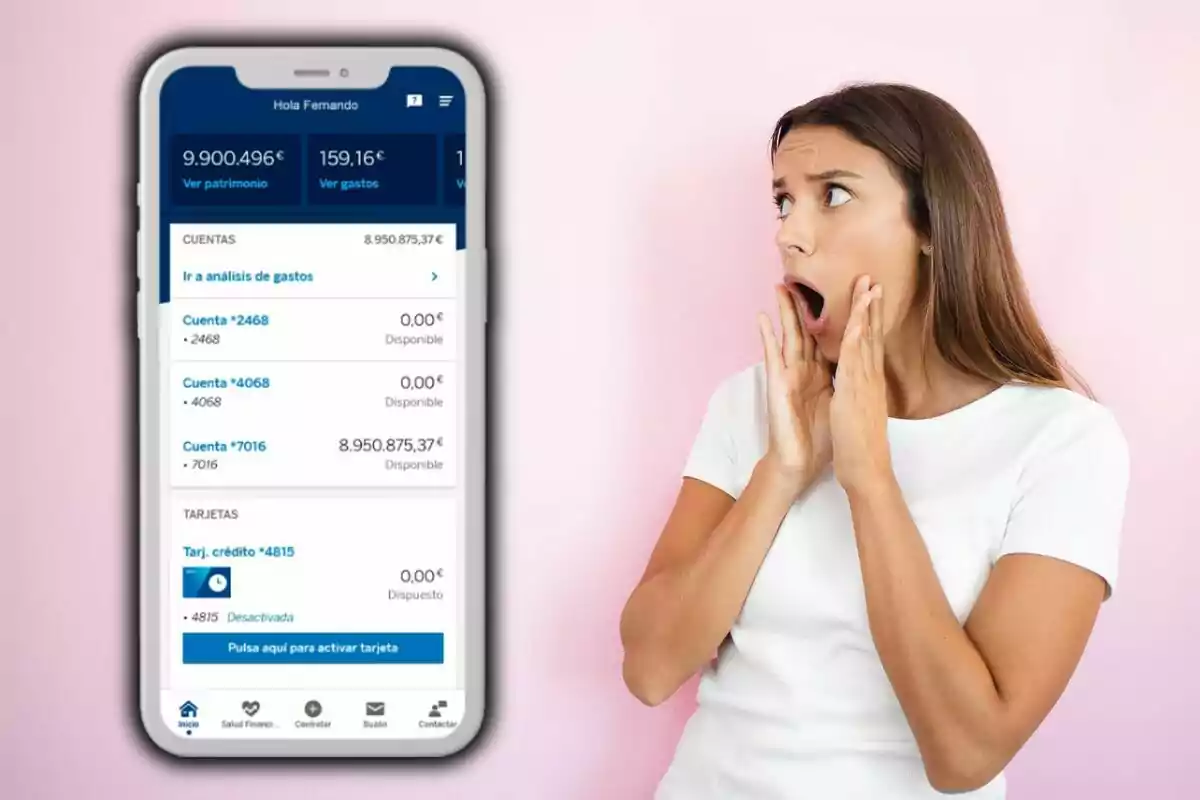

BBVA has launched a new initiative that makes it easier for customers to switch from another bank and manage their bills more easily. This new feature is available both on the website and in the BBVA app, offering a more comfortable and efficient experience.

BBVA doesn't want trouble with new customers: bring your bills easily

One of the main concerns when switching banks is managing direct debit bills. BBVA offers a simple solution through its "Bring your bills" service. This service allows you to automatically transfer bills for services like gas, electricity, phone, or internet from your old bank to your new account at BBVA.

To use it, you only need to provide one of your current bills, and BBVA takes care of the rest. To activate the "Bring your bills" option, follow these steps. Access the BBVA app or website: Log in with your credentials, select "Bring your bills."

In the main menu, look for this option and enter the bill details, providing information from one of your current bills. Confirm the transfer, and BBVA will manage the change of your bills to the new bank. This process is quick and secure, ensuring your payments are made without issues.

Other benefits of switching to BBVA

In addition to the economic promotion and bill management, BBVA offers other advantages when switching banks. These benefits make switching to BBVA an attractive and convenient option for thousands of Spaniards.

- Personalized advice: BBVA has a team of experts who will guide you through the entire bank switching process, ensuring a smooth transition.

- Advanced digital tools: The BBVA app and website are designed to offer an intuitive and secure experience, allowing you to manage your finances from anywhere.

- No fees: BBVA's Online Account Without Fees has no maintenance or administration fees, allowing you to save money each month.

What's more, BBVA has introduced an attractive promotion for those who decide to switch from another bank. By opening an Online Account Without Fees and direct depositing a salary or pension of 800 euros for a year, new customers can receive up to 720 euros in savings the first year.

This is achieved through a monthly refund of 60 euros for 12 months. Additionally, the account has no fees or additional requirements.

More posts: