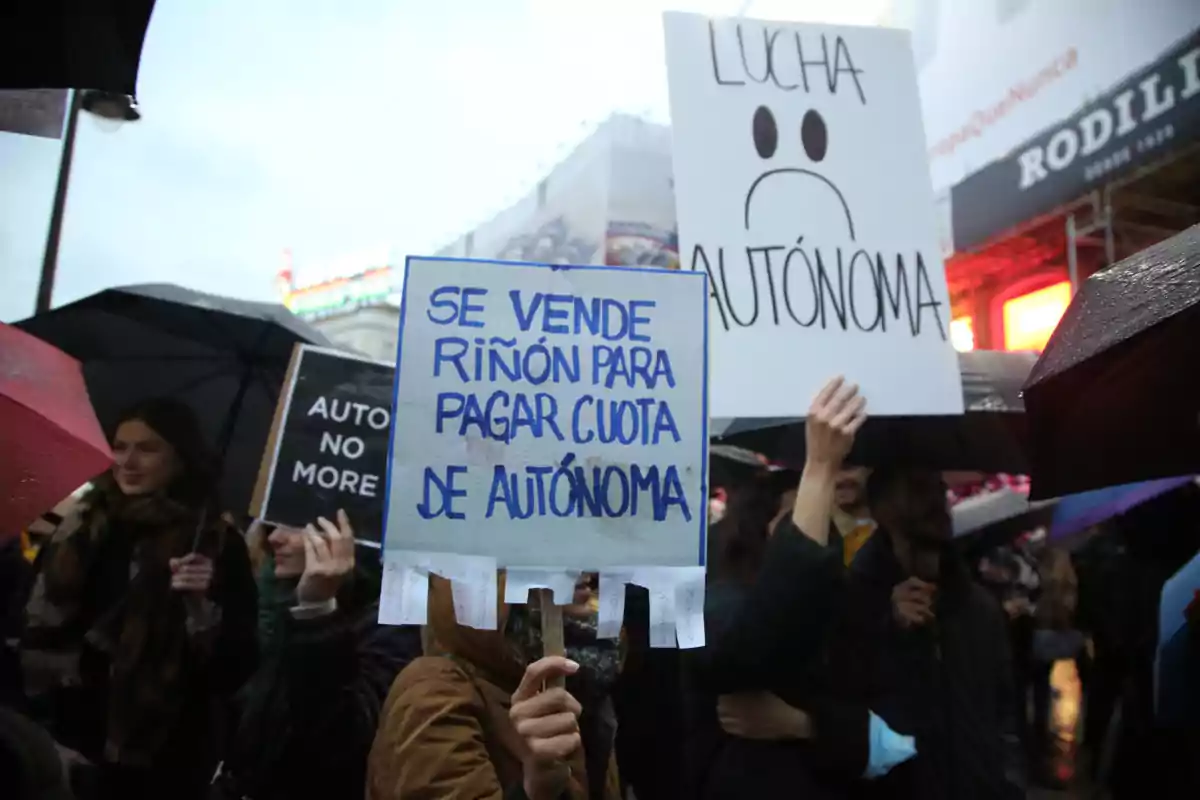

Tax pressure, labor costs, and bureaucracy: the impossible mission of being self-employed

97% of self-employed individuals believe that current policies don't adequately support them

Inclusion Minister Elma Saiz recently presented a highly revealing report on self-employed workers' contributions in 2023. According to the data, nearly 800,000 self-employed workers had to pay differences to Social Security for having contributed below their actual income. In total, contributions from more than 3.7M self-employed workers were reviewed, issuing 4.2M notifications to adjust their contributions.

This "regularization" process was launched after the close of the personal income tax campaign. With the usual fiscal rhetoric, the minister emphasized that this new system seeks a "fairer" model, where contributions are linked to actual income. As expected, self-employed workers see only another tax burden that, this time, is being justified for their own good:

In any case, the tax burden—intended to finance Social Security's unsustainable situation—is one of the many problems self-employed workers face. For all practical purposes, this is a mistreated sector that suffers twice the negative side of our economic model.

hiring a salaried employee, an unattainable goal for most

Despite their importance to the Spanish economy, most self-employed workers face significant barriers to expanding their activity. According to a report from the Ministry of Labor, 85.6% of self-employed workers can't afford to hire employees. Of the more than 3.4M registered self-employed workers, only 14.4% have at least one employee on staff.

Additionally, 53% of those who employ others can only keep one salaried employee, and only 10.7% have five or more. This difficulty in creating jobs reflects bureaucratic obstacles, the tax system, and high labor costs. In fact, it is precisely self-employed workers and small business owners who bear the brunt of rising labor costs, such as the increase in the minimum wage.

From a broader perspective, the situation hasn't improved in the past year. In fact, self-employed workers with employees decreased by nearly 10,000 people. Moreover, more than 269,000 self-employed workers depend on a situation of multiple activities to survive, combining self-employment and salaried work.

The Fifth National Study of the Self-Employed, conducted by Infoautónomos and the University of Granada, showed that 60% of self-employed workers have difficulty balancing their work and family life. Likewise, 80% can't afford more than 20 days of vacation per year, and an alarming 90% end up deregistering due to economic problems.

new self-employed workers, a foreign majority

Another notable fact about the current landscape is the profile of new self-employed workers in Spain. According to the Association of Self-Employed Workers (ATA), 96.5% of new entrepreneurs registered since 2021 are of foreign origin. Between March 2021 and March 2025, more than 104,000 foreign self-employed workers have registered, compared to fewer than 4,000 Spaniards.

This phenomenon occurs in almost all autonomous communities. In the Valencian Community, for example, more than 22,000 new foreign self-employed workers have registered. This figure far exceeds the just over 2,000 Spaniards who started activity in the same period. Only in Ceuta and Melilla has there been a decrease in the number of foreign self-employed workers.

the economic model

Foreign self-employed workers have offset the decline in traditional sectors such as commerce and agriculture. In addition, they have driven growth in areas such as construction, hospitality, and professional services. Specifically, the most significant increase is seen in construction, with nearly 17,500 new foreign self-employed workers. Other sectors with significant increases are scientific and technical activities, hospitality, and information and communication.

This is another manifestation of the deep changes taking place in the Spanish labor market, driven by demographics. As is well known, the absolute majority of Spain's labor force growth is due to immigration. In this sense, self-employed workers are no exception, even less so considering many of the low-productivity sectors in which they operate.

challenges that are difficult to solve

Bureaucratic obstacles, the lack of effective support from public policies, and the difficulty in hiring make the work of self-employed workers much more complicated. According to the data, more than 97% of self-employed workers believe that current policies don't adequately support self-employed workers. This shows a significant gap between the real needs of this group and government responses.

Just as is the case among business associations, self-employed workers' associations demand greater administrative simplification. In addition, in their case, they request improvements in the contribution system (essentially, not paying more) and measures that incentivize hiring. But the truth is that, with Social Security's pressure on the public budget, the room for fiscal improvement for self-employed workers is, for now, a utopia.

More posts: