Soaring inflation and sky-high taxes: Sánchez is running out of arguments

The 'progressive' government can't hide the fact that inequality has reached historic levels

Inflation is erasing the gains that Spanish families had experienced in recent years, which has intensified the process of widespread impoverishment. According to a report by ESADE, the average wealth of families increased from €335,000 in 2016 to €380,000 in 2022. However, this increase has been nullified by the effects of inflation. This has led to family wealth in 2022, in real terms, falling below 2019 levels.

This phenomenon of loss of purchasing power affects Spanish households unevenly. The richest 1% continue to accumulate a disproportionate share of wealth, while the poorest 50% of households barely accumulate 7%. In this context, the gap between rich and poor keeps widening. Inequality remains at alarming levels, with Madrid leading the wealth ranking, but also the inequality ranking.

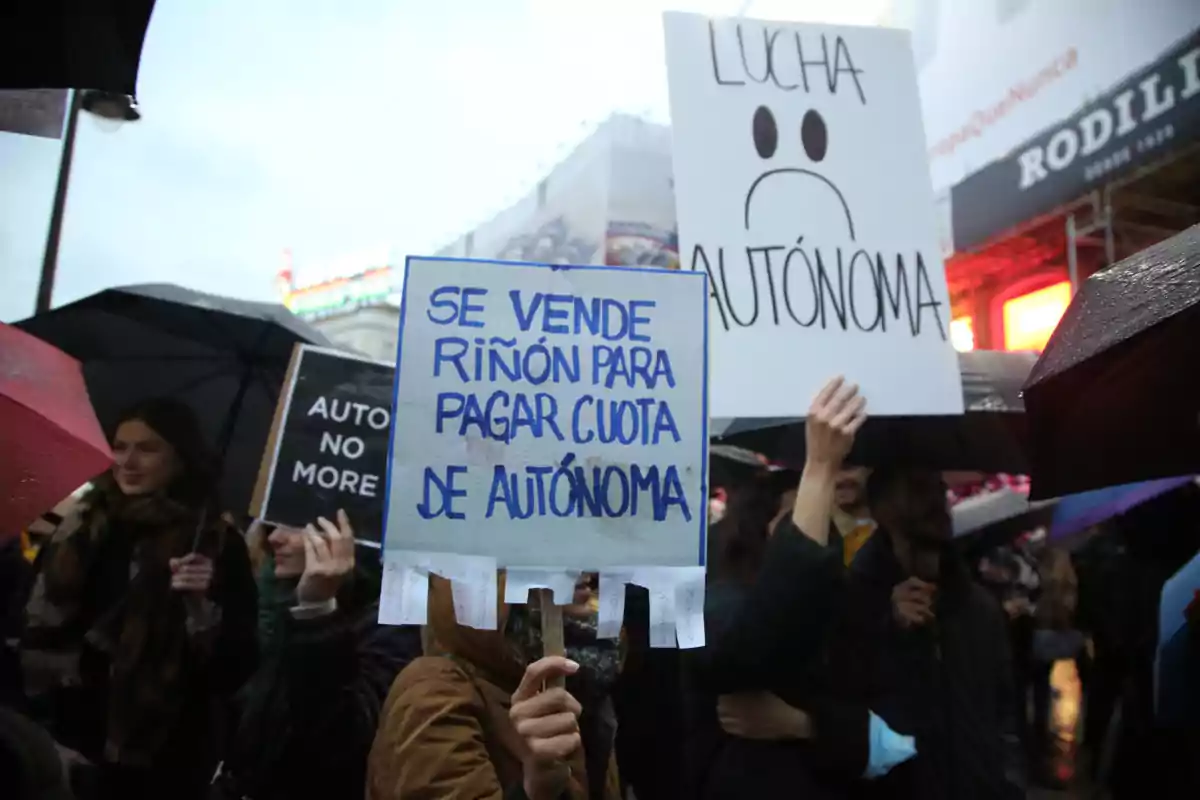

Impoverishment is not just a problem of a lack of wage increases. The tax burden has also increased significantly. According to Funcas, the tax burden has reached historic levels, which has increased income and consumption taxes. Since 2008, households not only earn less in real terms, but they also bear a greater tax burden. The tax burden index has risen from 100 in 2008 to 114.4 in 2024, while real net income has barely reached an index of 95.7.

This phenomenon, called "cold progressivity," refers to the lack of adjustment of personal income tax brackets to inflation. In other words, taxpayers pay more taxes without seeing a real increase in their income. Meanwhile, the average personal income tax rate has risen from 12.7% in 2019 to 14.4% in 2024. In addition, VAT has meant an extra cost of €438 for households between 2021 and 2024, which further increases the pressure on family finances.

In the background, the economic model

In addition to the fiscal impact, Spain's economic structure also contributes to impoverishment. Since the 2008 crisis, GDP per capita has remained stagnant, which has left Spain lagging behind the European economic core. The lack of productivity and the dependence on low value-added jobs worsen the situation.

The loss of purchasing power is even more evident in the housing market, where prices keep rising at a faster pace than wages. New generations, who face high housing prices and limited saving capacity, see their opportunities for capital accumulation reduced. This perpetuates intergenerational inequalities and limits long-term economic prospects.

If the current pace of real income growth is kept, Spanish families will take years to recover the purchasing power levels of 2008. Without tax reforms that adjust personal income tax brackets to inflation, impoverishment will be a cumulative process that will especially affect middle and lower incomes. In the end, the economic model proves that macro wealth can be perfectly divorced from micro reality.

More posts: