Urgent Message from PNC Bank to All Its Customers: Be Very Careful with Your Bank Account

PNC Bank Warns How a Compromised Account Number Can Cause Serious Financial Problems

As the world becomes digitalized, it has never been more relevant to protect personal financial information. With the rise of online banking, transactions, and digital payment methods, protection is more important than ever. A single security breach can have serious consequences.

For this reason, PNC Bank has taken proactive measures to educate its customers on how to identify and protect their bank account numbers. In a recent statement, PNC emphasizes the importance of knowing your account number and the potential risks of its misuse.

PNC Bank: Recognize Your Bank Account Number

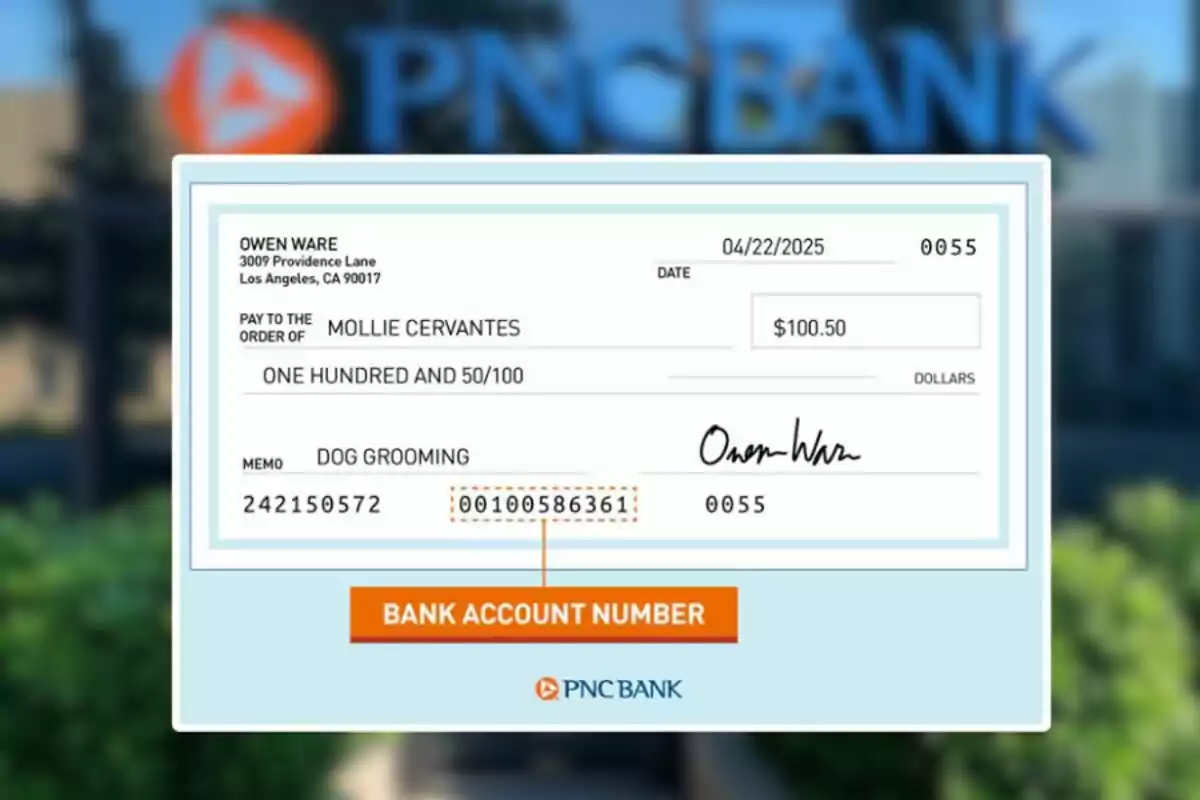

PNC Bank highlights the importance of recognizing your bank account number and understanding its role in managing your finances. Your account number is a unique identifier that distinguishes your account from others within the banking system. It is essential for conducting transactions such as deposits, transfers, and bill payments.

However, PNC Bank also warns that if someone gains access to your bank account number, they can cause you serious problems, such as unauthorized withdrawals or fraudulent transactions. For this reason, it is crucial to handle and share your account number with caution. Recognizing where your number is located on statements or checks will help you avoid accidental exposure.

PNC Bank: This Is How to Protect Your Bank Account Number

PNC Bank encourages its customers to take several measures to protect their account numbers, the first being to avoid sharing it. PNC Bank advises against sending account numbers through unsecured emails or text messages. These channels are susceptible to being intercepted by malicious actors.

Additionally, users should store their banking details in a safe place and regularly monitor their account statements for any unusual activity. PNC Bank also recommends using two-factor authentication for online banking as an additional layer of security for your account. If you suspect any strange activity, it is crucial to contact your bank immediately to mitigate potential issues.

PNC Bank's Commitment to Security and Education

To continue supporting its customers, PNC Bank offers educational resources on how to stay safe while managing their finances. These resources include tips for detecting phishing attempts, recognizing fraudulent transactions, and understanding security features in online banking services.

By providing these tools, PNC Bank seeks to empower citizens with the necessary knowledge to effectively protect their accounts.

PNC's commitment to the security of your financial information demonstrates its dedication to customer protection in an increasingly complex digital world. With the right precautions, you can minimize the risk of identity theft and financial fraud, ensuring that your money is protected.

More posts: